Key Takeaways:

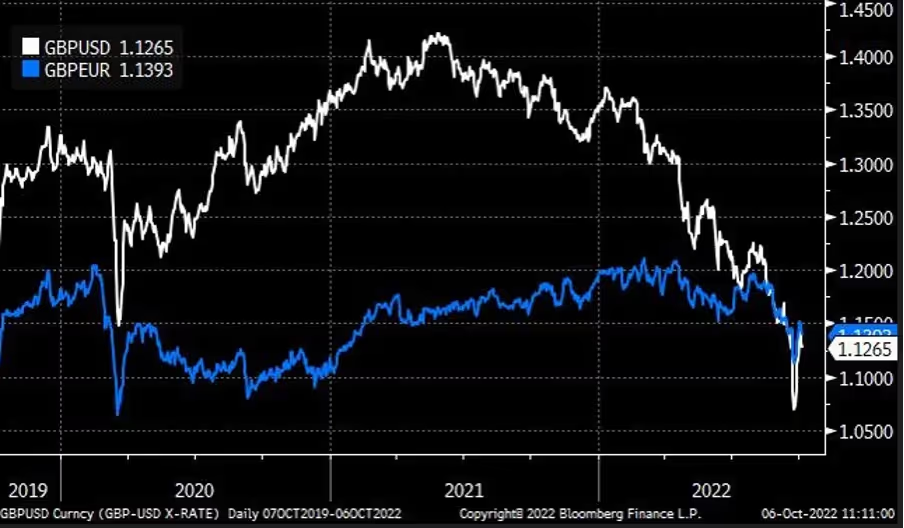

With recent global events such as the pandemic, the instability of sterling, the upcoming elections, and the continual issues surrounding the cost of living, it’s more important than ever to be aware of adverse fluctuations in the foreign exchange market regardless if whether or not your business makes international payments.

Even if a company doesn’t trade internationally, if they operate within a globally competitive industry, changes in exchange rate pairs can still affect operating profits. One way to manage the risk associated with foreign exchange is to book a forward contract.

Read on to learn more about forward contracts and why you and your business need them.

A form of currency hedging, a forward contract is an agreement when dealing with foreign exchange that guarantees, or “locks in'', an exchange rate for the sale or purchase of a specified currency for a period of time up to 24 months in the future. When trading internationally for your business, a forward contract with Equals Money can mitigate the currency risk surrounding your cross-border transactions. If the rate agreement is a favourable rate when the contract is agreed, you are guaranteed that rate for the agreed time of settlement.

Although should the rate continue to move after the contract has been agreed, you’ll still receive the original agreed exchange rate, presenting a potential disadvantage in choosing a forward contract. However, many customers find the stability and exchange rate certainty offered by a forward contract outweighs this disadvantage.1

The forward rate in a forward contract is the agreed-upon price at which a specific asset, such as a currency, commodity, or financial instrument, will be bought or sold at a future date. It is determined at the time the contract is established, based on several factors, including the current spot price or current market price, the time to maturity of the contract, interest rate differentials (for currencies), and the cost of carrying the underlying asset (for commodities).

For currencies, the forward rate considers the interest rate differential between the two currencies involved. For example, if the interest rate in the domestic country is higher than in the foreign country, the forward rate for the foreign currency might be lower than the spot rate, reflecting the cost of carrying that currency.

In essence, the forward rate reflects the market's expectations of the future price of the asset, adjusted for factors like interest rates and carrying costs, and is critical for both hedging and speculative purposes in forward contracts.

Over the last couple of years, businesses have faced tough trading conditions. The pandemic caused an exponential rise in shipping container costs and a surge in commodity prices while FX markets saw high levels of rate volatility. This combined with recent politics and the continual rising cost of living, there is still uncertainty and ever-preset volatility within the FX markets.

These levels of high volatility can add another potential headache for businesses when it comes to the impact on their bottom line.

By having an appropriate hedging strategy and using forward contracts, businesses can add another layer of protection to their bottom lines and mitigate risk when dealing with transactions across multiple currencies.

Forward contracts are a form of currency or FX hedging that allow a business to fix an exchange rate now for a requirement to buy or sell currency in the future. At Equals Money, we can offer contracts on most common currency pairs up to 24 months in the future.

This hedging tool allows you to take advantage of favourable exchange rates, protect yourself against adverse currency moves or market volatility, apply exchange rates to future cash flows, budget efficiently, and plan for future sales.

Forward contracts are primarily used by businesses, financial institutions, and traders who engage in international trade to hedge against exchange rate risk and speculate on future price movements. Businesses, such as manufacturers and importers, use forward contracts to lock in prices for commodities, currencies, or financial instruments, thereby protecting themselves from price volatility and ensuring predictable costs.

Financial institutions, including banks and hedge funds, engage in forward contracts to manage exposure to various markets and potentially profit from anticipated price changes. Exporters and importers also utilise these contracts to stabilise cash flows and reduce uncertainty related to currency fluctuations, enabling more accurate financial planning.

For example, if on the 1st of February 2022, a British import company is buying $1000 worth of goods from an American supplier and plans to complete the purchase in six months’ time, the importer may be concerned about any potential exchange rate fluctuations between USD and GBP during the next six months.

If the US dollar were to strengthen from its current spot price, the importer would have to pay more in sterling for their purchased goods. To better plan for their spending and costs, they decide to book a forward contract with Equals Money, ensuring they’ll get the current spot rate of 1USD = 0.73943GBP, which will cost the British company £739.43 when payment is due six months later.

After six months, on the 1st of July 2022, the spot rate is now 1USD = 0.82610GBP, meaning any concerns about the dollar strengthening were valid.

If the British importer were to now purchase the $1000 worth of goods, it would cost them £826.10. By using a forward contract instead of purchasing currency at the spot rate on the date of payment, they’ve saved £86.67 (10.49%). This level of cost could be harmful to your business’ spending, costs, and profit margins.

At Equals Money, we believe that FX hedging should be transparent, easy to implement, and should increase certainty on FX pricing. Forward contracts meet all these requirements.

Using forward contracts within a bespoke hedging strategy allows businesses to focus on business. While we help to mitigate the impact and risk associated with FX volatility, you can get back to what’s important: growing your business.

With Equals Money, you'll receive the support and expertise of a specialist currency account manager who can help you put together a strategy using a range of ideas for overseas payments, including forward contracts, bespoke currency hedging, and more.

1Equals Money can only offer forward contracts to facilitate payments for goods and services

This publication is intended for general information purposes only and should not be construed as financial, legal, tax, or other professional advice from Equals Money PLC or its subsidiaries and affiliates.

It is recommended to seek advice from a financial advisor, expert, or other professional. We do not make any representations, warranties, or guarantees, whether expressed or implied, regarding the accuracy, or completeness of the content in the publication.