Accounts

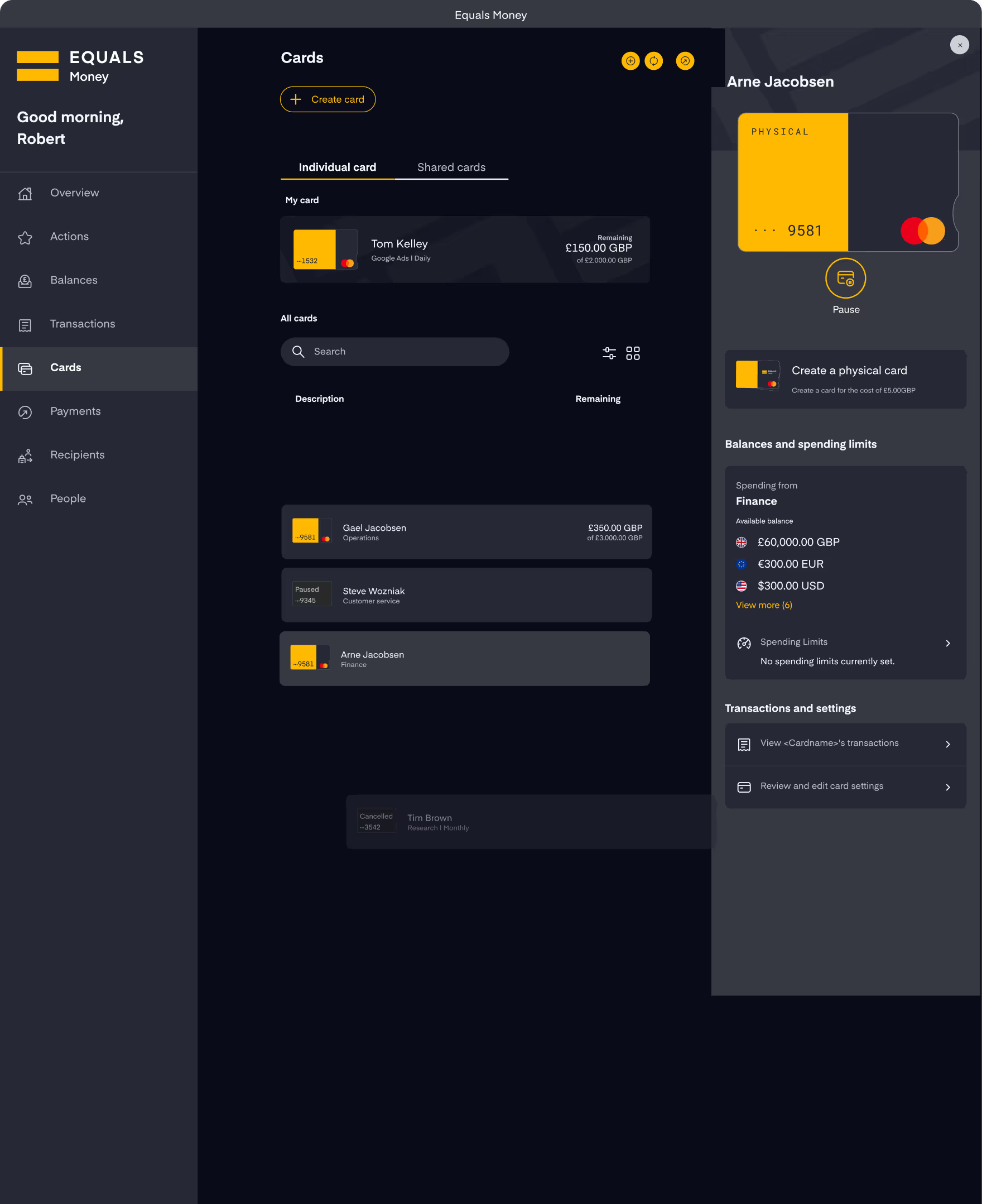

With unlimited users and instant-issue virtual cards, empower every employee to spend without lengthy approval processes.

Annotate purchase transactions to simplify reconciliation and integrate with accounting software to match accounts effortlessly.

Stay on budget with custom spending limits, transaction limits, and vendor controls to block specific merchants.

Empower your team to make secure purchases while maintaining full control. With customizable limits and detailed tracking, our purchasing cards make it easy to manage business expenses efficiently—all through a user-friendly platform designed for your needs.

A corporate purchasing card, commonly known as P-cards or procurement cards, is a type of payment card issued by companies to their employees for business-related purchases. Its primary purpose is to streamline the procurement process by enabling employees to directly purchase goods and services needed for their work without going through lengthy purchase order procedures. This enhances efficiency and reduces administrative costs as it usually comes with an accompanying procurement software.

P-cards are particularly useful for small, frequent purchases, such as office supplies, travel expenses, and minor equipment. They can be customised with spending and transaction limits and can be restricted with vendor controls, blocking specific merchant or types of purchases.

Additionally, modern P-cards often integrate with the company’s accounting systems or software, such as Xero, allowing for automatic reconciliation and real-time monitoring of expenses. This integration improves transparency, accountability, and budget management, ultimately contributing to better financial control and operational efficiency for the company.

Purchasing cards and commercial cards serve distinct purposes within business financial operations and therefore have some key differences. As mentioned, corporate purchase cards are specialised tools used primarily for streamlining the procurement process, controlling small, routine purchases and business expenses, thereby reducing administrative burdens, the need for purchase orders, and petty cash. Commercial cards, on the other hand, are used for a wide range of business expenses, including large transactions, travel costs, and operational expenditures.

However, with Equals Money there is no difference, as both types of cards function as an intended, spend management use case for our business expense cards.

All Equals Money cards are multi-currency Mastercards, available as prepaid or debit cards, designed to provide greater control over spending and financial visibility for businesses of all shapes and sizes.

Equals Money cards offer custom spending limits, that can be defined by a daily limit, monthly limit, yearly limit, or by lifetime. These bespoke limits, combined with real-time transaction data provide company-wide controls and insights, allowing finance teams greater financial management visibility into spending trends.