GBP continued to drop across the board yesterday despite no major news or data in the markets. USD traded within a tight range over the course of the afternoon, but following positive results from Apple last night, we saw a rise in equity futures which has resulted in weakness in USD ahead of today's job numbers.

*Daily move - against G10 rates at 7:30am, 03.05.24

** Indicative rates - interbank rates at 7:30am, 03.05.24

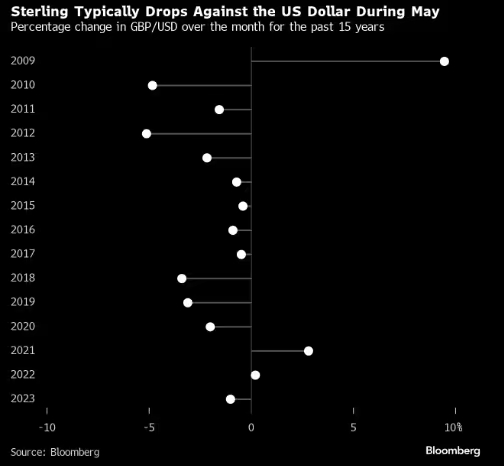

Following on from the Fed meeting on Wednesday, today's job numbers will be closely scrutinised on whether the data supports the idea that we could see a Fed rate hike this year. Should that be the case then this could well be the start of the 15-year seasonal trend where USD tends to outperform during the month of May. Should the numbers show some loosening in the job market, then we could see further moves beyond resistance levels on GBPUSD and EURUSD. Markets are expecting 240,000 job additions in April, down from 303,000 in March.

Whilst past performance is not indicative of future results, seasonal trends are still worth considering when looking at the implications on FX rates. As an example, GBP has finished lower versus USD during May in 12 out of the past 15 years, and in general USD has tended to outperform in May the same 15-year period. With Fed Powell suggesting current data does not indicate a rate hike by the Fed, could today’s job numbers contribute towards a lower move on GBPUSD?

Our team of currency experts are here to help you get more from your money when making cross-border transfers. We will work with you to understand your payment needs and offer specialised guidance on the best options available to you. Over the last 18 years we’ve helped over a million customers and last year alone processed over £10bn. We’re tried and trusted, and we’re ready to help you.

Have a great day.